Charity Bank: Your bank for good.

In this blog, we reveal the results of our 2024 borrower survey to show just how Charity Bank loans have benefited organisations working for social good across the UK.

Since 2002, Charity Bank has been using loan finance to empower the social sector, providing crucial support to charities and social enterprises striving to make a difference.

Our latest borrower survey, conducted between March and April 2024, highlights the impact of our loans and the lasting benefits of our partnership with organisations dedicated to improving the lives of individuals, strengthening communities, and protecting the planet.

These results showcase how our loans have helped social purpose organisations thrive.

Loans for strengthening social purpose organisations

- 51% of our borrowers stated that their loan financed initiatives that grant funders typically do not support, such as long-term capital investments or operational costs that are essential for growth. By giving these organisations the flexibility to allocate funds where they are most needed, we help them pursue projects that align with their strategic goals.

- 78% of borrowers said their loan helped improve the quality of services or facilities. Whether it’s upgrading essential equipment, renovating community spaces, or introducing new technologies, these investments allow organisations to better meet the needs of the people they serve.

- 82% felt that the loan increased the likelihood of their organisation’s growth. By providing access to capital, we help unlock opportunities for expansion, innovation, and new initiatives.

- 33% reported reduced operational costs thanks to their loan. With lower costs, these organisations are able to redirect resources toward their core mission, improving efficiency and enabling them to offer more to their communities.

- 31% of borrowers credited their Charity Bank loan with helping their organisation stay afloat. In challenging times, such as during economic crises or funding gaps, our loans have provided the crucial financial lifeline that allowed these organisations to continue their work without interruption.

- 32% of borrowers used their loans to diversify their income streams, reducing their reliance on single sources of funding. This financial diversification is critical for long-term sustainability, allowing organisations to weather financial uncertainties with greater confidence and stability.

- 60% were able to increase the number of services they provide, extending their reach and broadening their impact. Whether it’s adding new programs or expanding existing ones, Charity Bank loans are helping to ensure that more people in need can access vital services.

Loans for growing charities and social enterprises

Our loans help organisations grow in various areas. Our surveyed borrowers agreed that their loan either directly or indirectly led to growth in the following areas:

- Services: 72% agreed that they were able to increase the services they offer to their beneficiaries.

- Assets: 83% reported growth in their facilities/assets.

- Income: 51% saw an increase in income through additional sources of funding such as grants, contracts, or further loans.

- Volunteers and staff: 25% reported an increase in the number of volunteers and 26% said that they were able to increase their number of employees.

Loans for sustaining the social sector

Periods of economic instability, such as the Covid-19 pandemic and the cost-of-living crisis, have tested the resilience of social purpose organisations.

According to our survey, 66% of borrowers said that Charity Bank’s loans and support put them in a more resilient position during these crises. Additionally, 55% felt better equipped to respond to these challenging times due to their relationship with Charity Bank.

We’re proud to be seen as a trusted partner in difficult periods, with 79% of our borrowers finding us patient and understanding in their interactions.

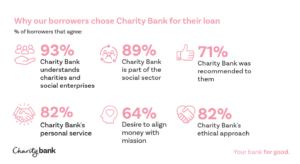

Why our borrowers chose Charity Bank for their loan

Our borrowers choose us because we understand their unique challenges and mission-driven goals. According to the survey:

- 93% agree that Charity Bank understands charities and social enterprises.

- 89% value that we are part of the social sector, just like them.

- 82% appreciate our personal service and ethical approach.

- 64% chose Charity Bank because they wanted to align their money with their mission.

- Furthermore, 96% of our borrowers stated that their loan helped them deliver on their mission, with 60% saying it made a major positive contribution.

Looking for a Loan?

If your charity or social enterprise is seeking a loan to support its mission, Charity Bank is here to help. We are your bank for good. In fact, 94% of our borrowers would recommend us. To find out more about how we can support your organisation, please visit Charity Loans For UK Charities & Social Enterprises – Charity Bank

Borrower Survey

Charity Bank’s impact surveys were conducted between March and April 2024. The borrower survey was offered to 418 of its current borrowers, with 157 completing the survey (a 37.5% response rate).

About Charity Bank

Charity Bank is the loans and savings bank owned by and committed to supporting the social sector. Since 2002, we have used our savers’ money to make more than 1380 loans totalling over £580m to housing, education, social care, community and other social purpose organisations.

Nothing in this article constitutes an invitation to engage in investment activity nor is it advice or a recommendation and professional advice should be taken before any course of action is pursued.