Loans

Loans

Our Loans

If you’re looking for a loan to help further your social mission, you’re in the right place.

Our mission is to support your mission

We offer loans to small, medium and large organisations where the loan is being used for a social purpose.

Supporting the social sector for over 20 years

We lend to charities, social enterprises and organisations tackling social and environmental issues and shape our terms and repayment schedules around their needs.

Why Charity Bank?

We’re more than just an ethical bank. For over 20 years, we’ve created positive social change in everything we do. All our shareholders are charities and social impact investors. All our borrowers are delivering social impact. And every loan, deposit and investment helps drive real change for people, communities and the planet – now, and for the long term.

Why our customers choose us

We understand our customers

Our values and ethics

Flexibility in lending

Excellent customer service

Relationship & tailored support

Limited options from other banks

Our Loans

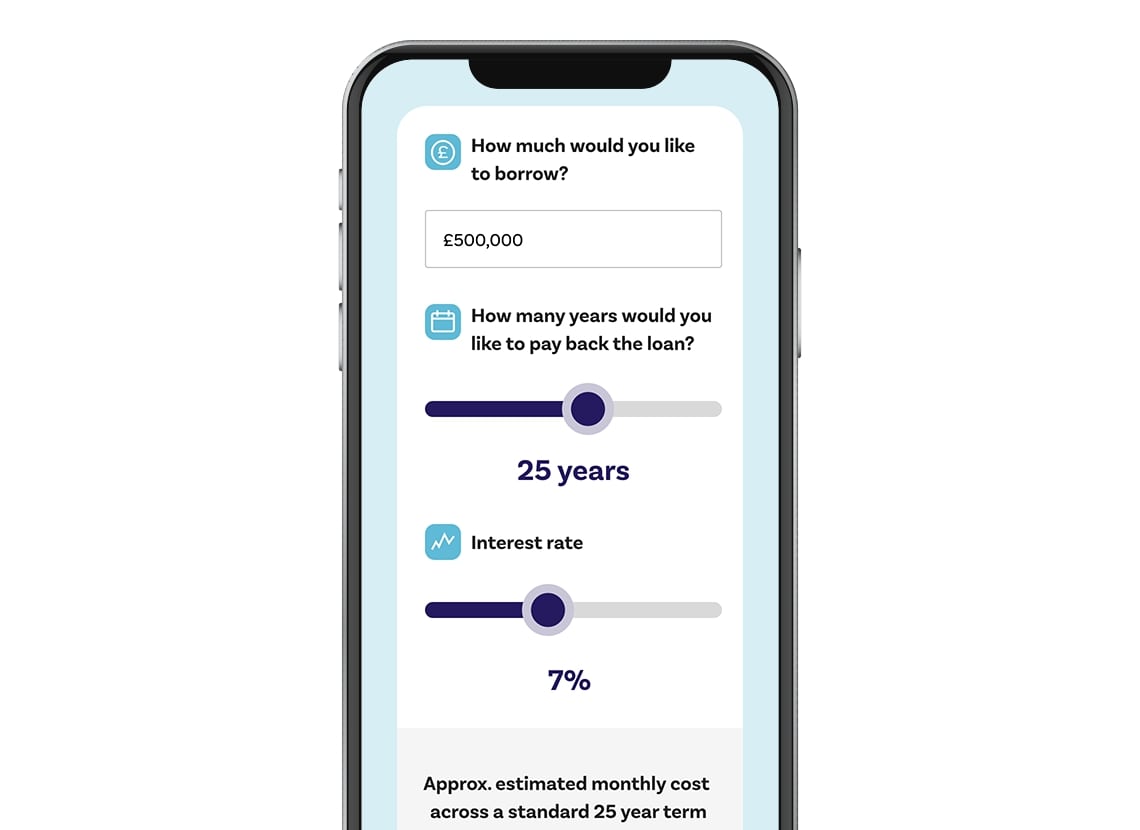

Loans up to £500k

Loans up to £500k:

- Specialist support from our Social Investment Solutions team

- Secured lending up to 70%

- Loans starting at £150,000

Loans over £500k

Loans over £500k:

- Dedicated support from our Impact Lending team

- Secured lending up to 70%

- Charity and social sector specialist

Green Loans

Green Loans:

- Dedicated environmental product

- Secured lending up to 70%

- Loans starting at £150,000

Development Finance

Development Finance:

- Expertise in development and construction projects

- Secured lending up to 70%

- Housing and non-housing projects considered

Look at our impact across the UK

Hover over the map below to see how much we’ve lent to charities and social enterprises in your region since 2002. Click on a region to see how much we’ve lent to organisations in each area.

United Kingdom

£629,638,133

Total amount of money

1461

Total number of loans

| Region | Amount of money | Number of loans |

|---|---|---|

| Eastern | £46,241,056 | 130 |

| East Midlands | £29,623,278 | 85 |

| London | £191,117,924 | 249 |

| North East | £18,561,395 | 39 |

| Northern Ireland | £6,740,028 | 12 |

| North West | £43,722,802 | 130 |

| Scotland | £21,092,107 | 77 |

| South East | £101,428,895 | 227 |

| South West | £52,532,529 | 179 |

| Wales | £11,790,463 | 56 |

| West Midlands | £48,654,395 | 107 |

| Yorkshire & Humber | £58,133,261 | 170 |

Eastern

£46,241,056

Total amount of money

130

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Bedfordshire | £2,545,800 | 10 |

| Cambridgeshire | £11,356,689 | 23 |

| Essex | £19,754,497 | 41 |

| Hertfordshire | £5,121,725 | 19 |

| Norfolk | £4,535,403 | 21 |

| Suffolk | £2,926,942 | 16 |

East Midlands

£29,623,278

Total amount of money

85

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Derbyshire | £4,433,881 | 27 |

| Leicestershire | £8,514,634 | 16 |

| Lincolnshire | £6,535,531 | 14 |

| Northamptonshire | £2,540,232 | 11 |

| Nottinghamshire | £7,409,000 | 15 |

| Rutland | £190,000 | 2 |

London

£191,117,924

Total amount of money

249

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Barking and Dagenham | £2,026,000 | 5 |

| Barnet | £14,002,044 | 20 |

| Bermondsey | £812,500 | 1 |

| Bexley | £1,575,000 | 1 |

| Brent | £5,757,891 | 10 |

| Bromley | £1,451,044 | 3 |

| Camden | £14,656,270 | 12 |

| City of London | £8,477,750 | 9 |

| Croydon | £358,000 | 3 |

| Ealing | £5,973,500 | 9 |

| Enfield | £3,635,500 | 4 |

| Greenwich | £10,255,119 | 8 |

| Hackney | £10,857,274 | 16 |

| Hammersmith and Fulham | £5,952,401 | 7 |

| Haringey | £5,138,000 | 7 |

| Harrow | £12,233,645 | 9 |

| Havering | £4,264,391 | 8 |

| Hillingdon | £4,181,667 | 2 |

| Hounslow | £2,450,000 | 2 |

| Ilford | £1,375,000 | 2 |

| Islington | £4,933,935 | 18 |

| Kensington and Chelsea | £941,772 | 3 |

| Kingston Upon Thames | £2,971,250 | 6 |

| Lambeth | £13,062,000 | 16 |

| Lewisham | £3,903,371 | 2 |

| Merton | £4,117,000 | 3 |

| Newham | £9,738,069 | 13 |

| Redbridge | £1,267,500 | 1 |

| Richmond | £215,000 | 1 |

| Southwark | £2,010,995 | 14 |

| Sutton | £423,199 | 1 |

| Tower Hamlets | £3,271,912 | 11 |

| Waltham Forest | £1,380,000 | 1 |

| Wandsworth | £8,305,520 | 5 |

| Westminster | £19,143,405 | 16 |

North East

£18,561,395

Total amount of money

39

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Durham | £7,398,809 | 15 |

| Middlesbrough | £144,000 | 1 |

| Northumberland | £1,770,000 | 7 |

| Tyne and Wear | £9,248,586 | 16 |

Northern Ireland

£6,740,028

Total amount of money

12

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Antrim | £5,920,310 | 8 |

| Derry City and Strabane District | £100,000 | 1 |

| Fermanagh and Omagh | £599,718 | 1 |

| Newry, Mourne and Down | £120,000 | 2 |

North West

£43,722,802

Total amount of money

130

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Cheshire | £10,012,652 | 13 |

| Cumbria | £6,672,046 | 31 |

| Greater Manchester | £5,591,435 | 24 |

| Lancashire | £11,272,052 | 30 |

| Merseyside | £10,174,617 | 32 |

Scotland

£21,092,107

Total amount of money

77

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Angus | £150,000 | 1 |

| Argyll & Bute | £1,074,117 | 15 |

| Aryshire | £284,840 | 3 |

| City of Edinburgh | £1,124,757 | 7 |

| Dumfries & Galloway | £241,000 | 3 |

| Dundee | £320,000 | 2 |

| Fife | £1,463,761 | 2 |

| Lanarkshire | £15,057,785 | 34 |

| Midlothian | £888,847 | 3 |

| Perthshire | £62,000 | 2 |

| Renfrewshire | £212,000 | 2 |

| West Dunbartonshire | £60,000 | 2 |

| West Lothian | £153,000 | 1 |

South East

£101,428,895

Total amount of money

227

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Berkshire | £2,930,205 | 11 |

| Buckinghamshire | £7,620,020 | 18 |

| East Sussex | £15,214,257 | 34 |

| Hampshire | £14,895,642 | 34 |

| Isle of Wight | £132,500 | 1 |

| Kent | £21,260,164 | 59 |

| Oxfordshire | £7,110,205 | 13 |

| Surrey | £29,409,080 | 39 |

| West Sussex | £2,856,822 | 18 |

South West

£52,532,529

Total amount of money

179

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Bristol | £7,252,750 | 8 |

| Cornwall | £8,606,444 | 19 |

| Devon | £11,467,904 | 42 |

| Dorset | £3,581,079 | 21 |

| Gloucestershire | £10,622,573 | 24 |

| Somerset | £7,850,605 | 35 |

| Wiltshire | £3,151,174 | 30 |

Wales

£11,790,463

Total amount of money

56

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Anglesey | £20,000 | 1 |

| Cardiff | £4,565,956 | 12 |

| Carmarthenshire | £369,800 | 4 |

| Ceredigion | £1,213,872 | 8 |

| Conwy | £20,000 | 1 |

| Denbighshire | £127,175 | 1 |

| Gwynedd | £1,994,100 | 11 |

| Monmouthshire | £130,000 | 2 |

| Pembrokeshire | £480,000 | 4 |

| Powys | £637,000 | 3 |

| Rhondda Cynon Taff | £780,000 | 5 |

| Torfaen | £1,196,921 | 1 |

| Vale of Glamorgan | £95,200 | 1 |

| Wrexham | £160,439 | 2 |

West Midlands

£48,654,395

Total amount of money

107

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| Herefordshire | £500,000 | 2 |

| Shropshire | £1,872,500 | 10 |

| Staffordshire | £8,815,303 | 30 |

| Warwickshire | £940,030 | 5 |

| West Midlands | £35,216,562 | 54 |

| Worcestershire | £1,310,000 | 6 |

Yorkshire & Humber

£58,133,261

Total amount of money

170

Total number of loans

| County | Amount of money | Number of loans |

|---|---|---|

| East Riding of Yorkshire | £3,526,850 | 12 |

| Lincolnshire | £4,364,600 | 4 |

| North Yorkshire | £17,952,799 | 52 |

| South Yorkshire | £15,652,069 | 53 |

| West Yorkshire | £16,636,943 | 49 |

Lending across the Social Sector

We lend to a range of sectors, focusing on creating positive social impact. Here are some of the key sectors we support:

Arts

Community

Education

Environment

Faith

Health & Care

Social Housing

Sport

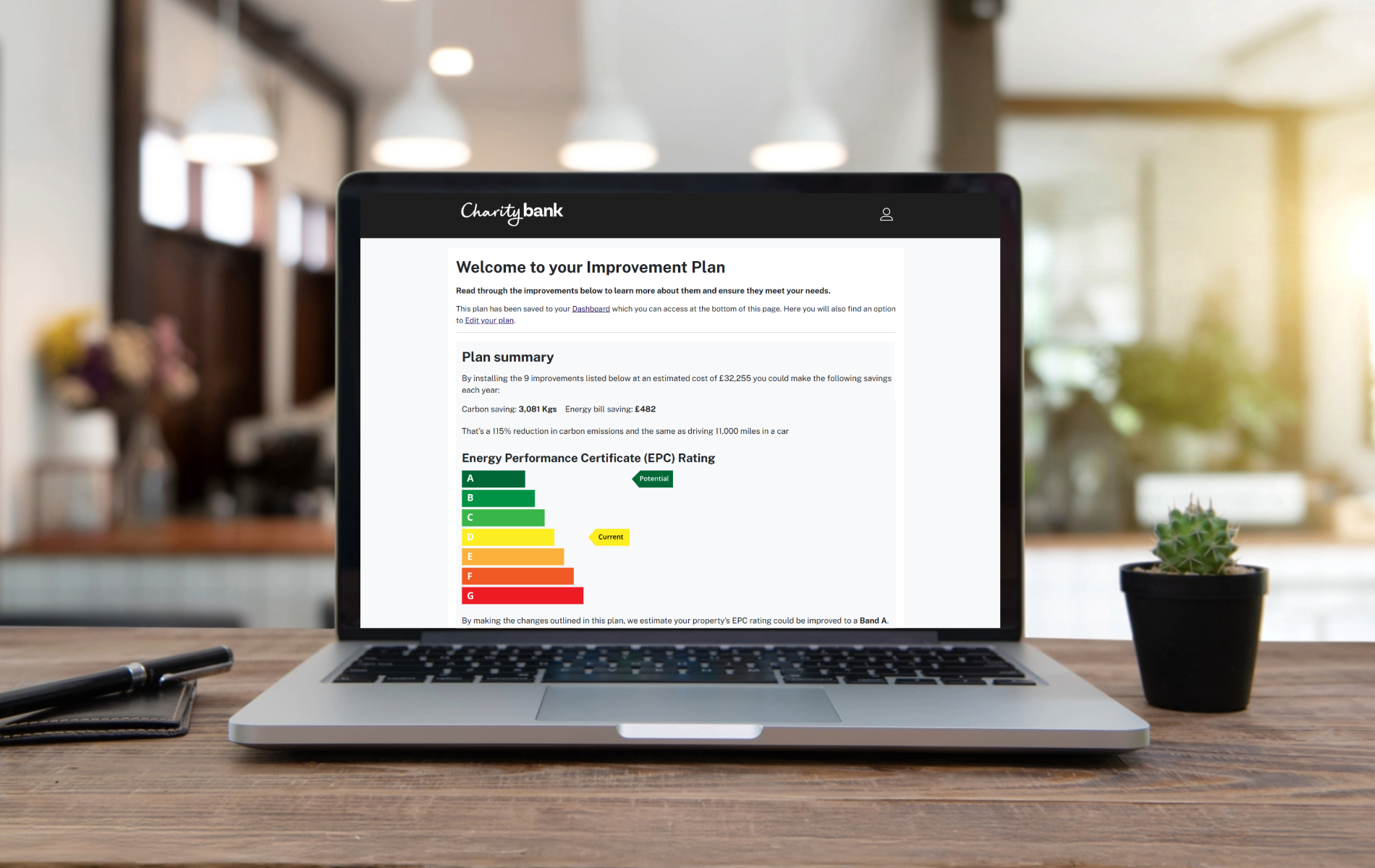

Energy Savings Trust Tool

We’ve teamed up with Energy Savings Trust to provide an energy tool for Charities & Social Housing providers.

The tool can be used to assess and improve the energy efficiency of Residential Properties—cutting costs and supporting a greener future.

Find out how to improve the energy efficiency of your property today.

View our EST toolMeet our Lending Team

You’ll get to know our regional managers by name. They take the time to meet you and tailor our loans to suit your financial need and social aims.

FAQs

Who do you lend to?

We only lend to organisations based in the UK. We lend to most organisations that have a social purpose and can repay the required loan.

What can I use the loan for?

A loan can be used for any legal purpose which supports the social objectives of the organisation. The loan purpose will be agreed and approved as part of the application process; should circumstances change, the borrower must let us know and any adjustments will need to be agreed.

Looking for broker partnerships?

If you’re a Broker looking to help organisations maximise their social impact, explore our dedicated Broker Guide to learn more about our broker partnerships at Charity Bank.